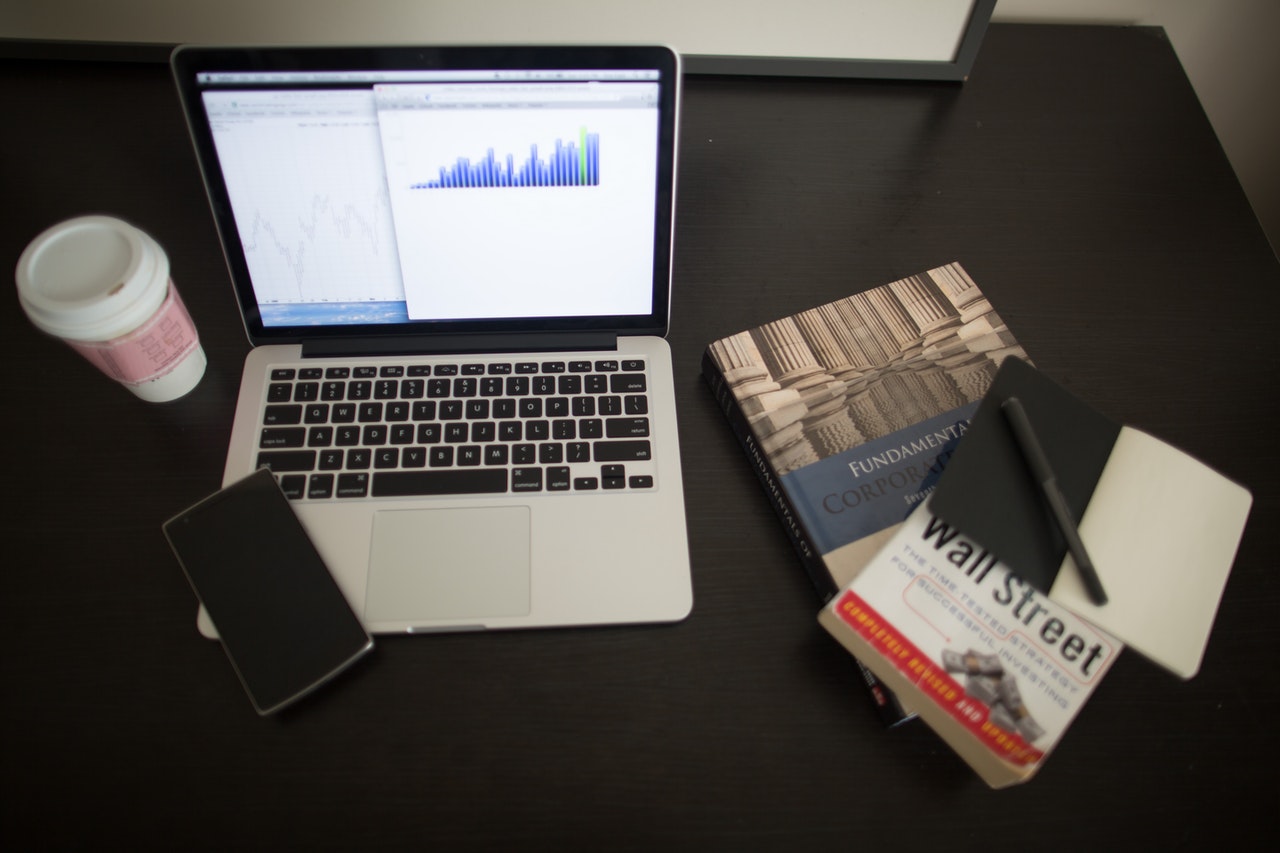

The Internet has become a one-stop destination for the average person’s needs. From researching a restaurant’s address and food delivery service number to doing bank transactions, almost everything and every service are now available online.

What’s truly impressive is the financial and banking sectors’ eager transition from in-branch to online services. It’s no secret that the Internet is not secure. Cybercriminals intent on stealing personal information and money from commercial entities lurk in every corner, looking for vulnerabilities in online security and fooling consumers into revealing their banking details. And yet, banks and lending institutions are now making the Internet one of their main channels for business transactions.

Online Security: The Key to More Integration

Driven by necessity, the financial and banking industries continue to invest in the best security infrastructure they could buy or innovate. Cybersecurity is crucial because it is the one factor that enables financial institutions to make their services available online.

Approximately 2,935 breaches were publicly reported in the first quarter of 2020 alone. While the biggest breaches were non-finance, the incidents are a reminder that online thefts center primarily on consumer information.

The COVID-19 pandemic has also been a learning experience for cybersecurity experts. Ransomware attacks increased and intensified in 2020 with victims paying an average of $1.1 million. Moving forward, IT security teams must strengthen their firewalls against ransomware and secure the expertise of a chief information security officer.

Other Digital Trends for Finance

As the pandemic carries on to 2021, the industry will continue to make financial products and services available through the Internet. With this premise, here are three trends we can expect from next year onward.

- Creation of online equivalents of offline services.

Many lending companies have made their services entirely available online, and it is expected that big banks will follow suit. Lending companies have had the advantage on this front because they could offer loan options with less stringent requirements. Some, for example, offer online applications for personal loans for low credit scores. Many major banks have yet to offer online loan applications possible or guarantee a swift, all-online underwriting service. With the pandemic preventing many from leaving their homes, however, banks will most likely change their protocols.

- Creation of online tools for a seamless digital banking experience.

Online personal banking is one area in which many major banks excel. Mobile apps and website-based banking portals have already been widely used even before the pandemic. Now that digital banking is taking over, and the need for social distancing continues, banks and financial institutions that can engage and serve their clients online will have a huge advantage over those that cannot.

The goal of creating such tools is to provide clients with a smooth, seamless online experience doing online banking and personal financial management. This is now a priority in the banking industry because customer behavior and preferences have evolved due to the pandemic. As findings from JP Morgan’s 2020 Digital Banking Attitude Survey revealed, 80% of consumers prefer to manage their finances digitally.

- Acquisition of top cybersecurity talents.

Given that banks and financial institutions are moving rapidly towards digitization, experts in cybersecurity will be even more in-demand. Institutions may also have to restructure as they fill gaps in their IT and security teams. It’s challenging finding qualified talents under normal circumstances, but more so now that prospective hires are in high demand. Fortunately, with the current trend of remote working, institutions are now more open to hiring remote workers to fill positions that don’t have to be present on the office premises.

Many of the current financial technology trends are driven by the pandemic. There’s every indication, however, that consumers will continue to take advantage of digital and online financial services even after the worst of the crisis passes. And to meet these demands, institutions must integrate digital and online processes into their offline services.